Next generation

onboarding and

model portfolio service

for financial advisors

and enterprises

Cutting-edge tools to help attract more clients, save time

grow your revenues, and differentiate your advisory firm in the market

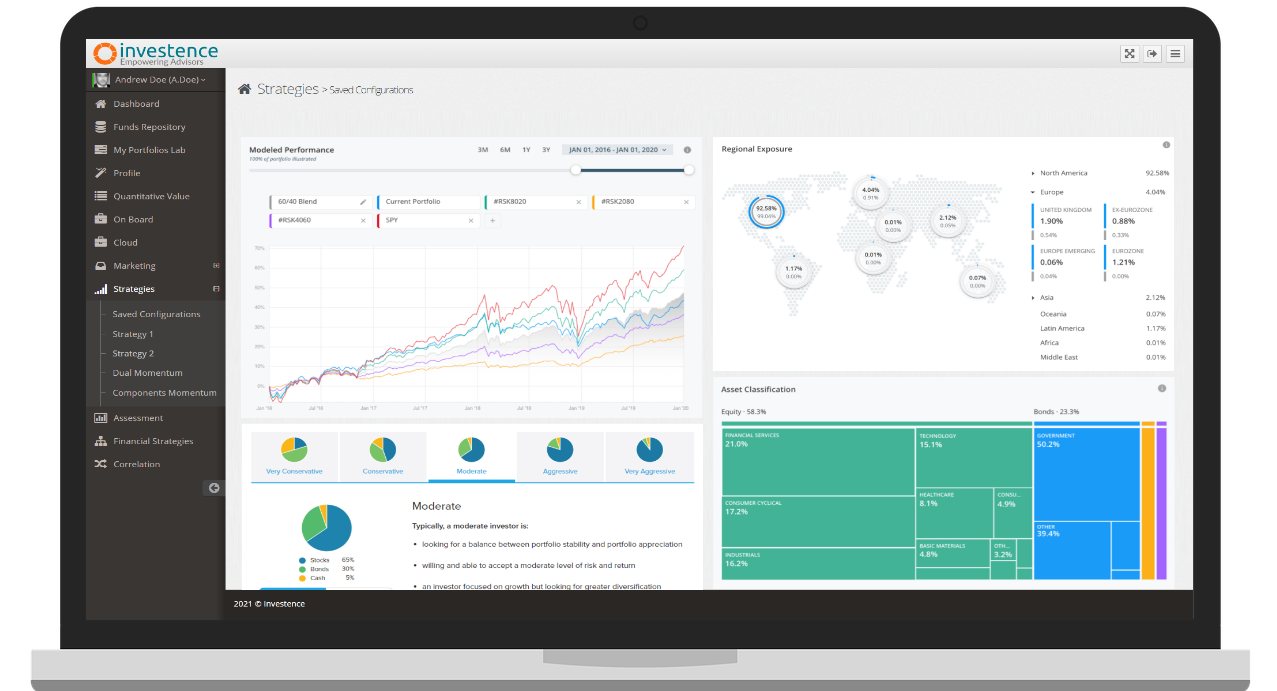

Asset Allocation and rebalancing are the most important determinants of overall portfolio performance, but many top-down and multi-asset investment portfolios are managed on the most rudimentary systems. Investence’s Asset Allocation module provides a robust, high-quality and institutionally-trusted solution for managing and mantain policy weights.

- Monitor that TAAs adhere to policy

- Monitor funds against their benchmarks easily

- Merge different evidence based strategies

The power of unified advice

- CRM

- Contact Management

- Activity Streams

- Opportunity Tracking

- Asset Allocations Lab

- Policy Weights Management

- Portfolio Construction

- Portfolio Construction

- Risk Assessment

- Risk Tolerance Toolkit

- Mapping Services

- Investor Profiler

- Backtesting Engine

- Benchmark-Relative Performance

- Performance Contribution

- Custom Return Periods

- Content Marketing

- Omnichannel marketing

- Lead nurturing

- Compliance workflow

- Client Portal

- Portfolio Views

- Document Vault

- Activity Management

Innovative Solutions To Streamline Investment Management

How can Investence help you deliver financial wellness?

Investence's data, technology and services empower financial advisors and enterprises to advise on all financial aspects

Investence focuses on building a seamless-integrated-network of tools that provide advisors with the choice, control, convenience and transparency they need to help deliver a full life cycle of advice to their clients, so that achieving financial wellness can be possible..

Boost your investment management capabilities

Learn more about how Investence can empower your practice.