Confidently create and deliver well-diversified investment portfolios

Use our platform to build portfolios that align with your clients’ risk tolerance and ensure the focus stays on their long-term goals.

Actionable Planning Made Easy

Build recommendations on a strong foundation of proven tools and academic research.

When managing a growing book of business, an advisor’s greatest challenge is time. There’s only so much time in the day, and only so many aspects of the investment experience you can manage, effectively, within that time.

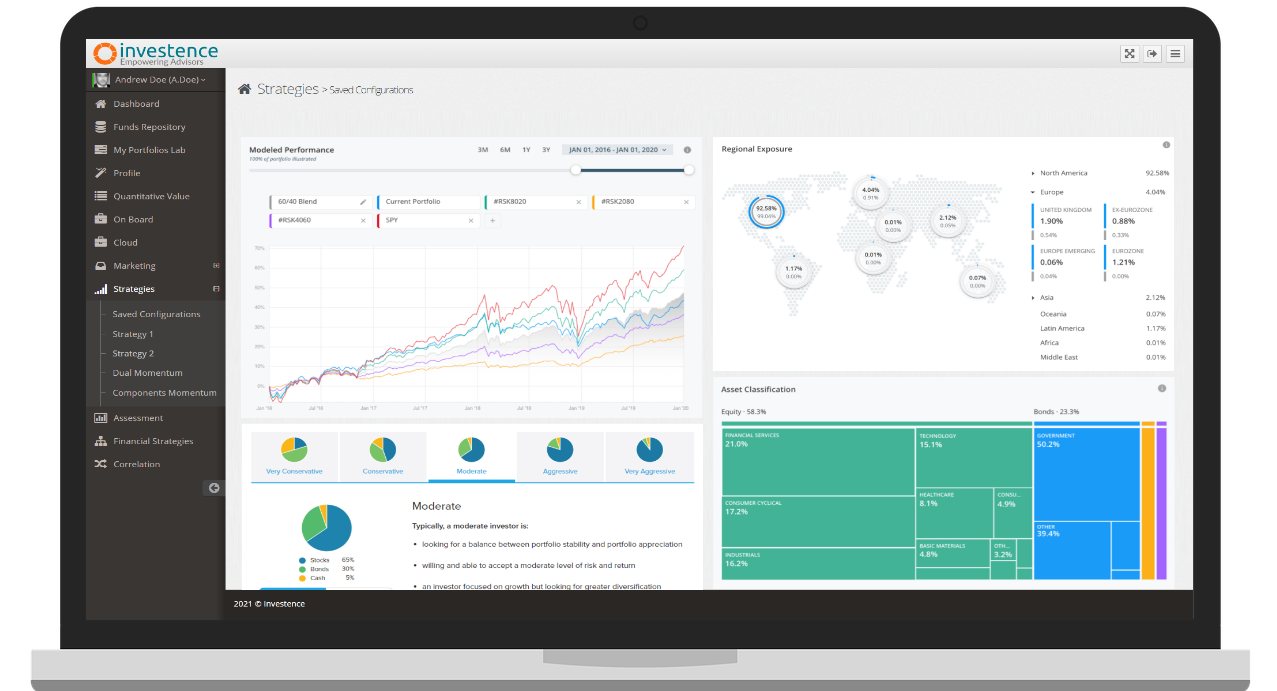

Use our proposal generator to recommend an asset allocation, which you can customize to your clients' needs. When you record client requirements in an investment policy statement, the platform will alert you to review or rebalance.

Our approach is grounded in empirical and academic research and the long-term observation of markets and how they work.

From Assets to Outcome

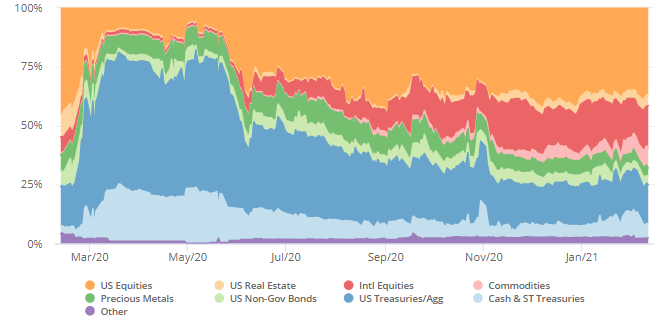

Combining and rebalancing strategic asset allocation provides the greatest potential for maximising risk adjusted returns.

Investence allows financial advisors to merge multiple evidence based tactical asset allocation strategies together into what we call Strategies Ensemble. We think that combining science backed strategies rather than combining assets provides better value. This approach based on data and evidence reduces the risk of any single strategy underperforming.

Portfolio Analytics

Next-generation quant tools that provide cost-effective solutions for more efficient portfolio management.

Our tools integrate easily into your financial planning process to rapidly diagnose any portfolio, spot weaknesses and opportunities:

- Construct sub portfolios that complement your core investment strategy.

- Overlay our science backed risk measures on your existing strategies.

- Sophisticated and automated portfolio backtesting.

- Create watchlists and define your investment universe.

Oversight by Experts

Investence brings decades of investment management experience to the development of our tools and procedures.

This also includes industry experts, with a strong academic background, outside of Investence in areas like: regtech, behavioural finance, ecometrics and statistical methods.

Effective Risk Profiling & Capacity for Loss

With a joined-up platform, Investence provides both the tool to determine attitude to risk and capacity for loss of each client and maps them to a suitable portfolio. We eliminate the suitability gap from differing risk rating methodologies between investment managers and advisers.

Our platform ensures ongoing suitability by providing annual risk assessment follow ups and notifying the adviser and investment team of any changes required for the client.

Boost your investment management capabilities

Learn more about how Investence can empower your practice.