A platform that empowers advisors with better intelligence to help make financial wellness a reality

From portfolio construction and investment research to client communication and prospecting, our wealth management technology provides advisors with the means of transforming their practice for the better

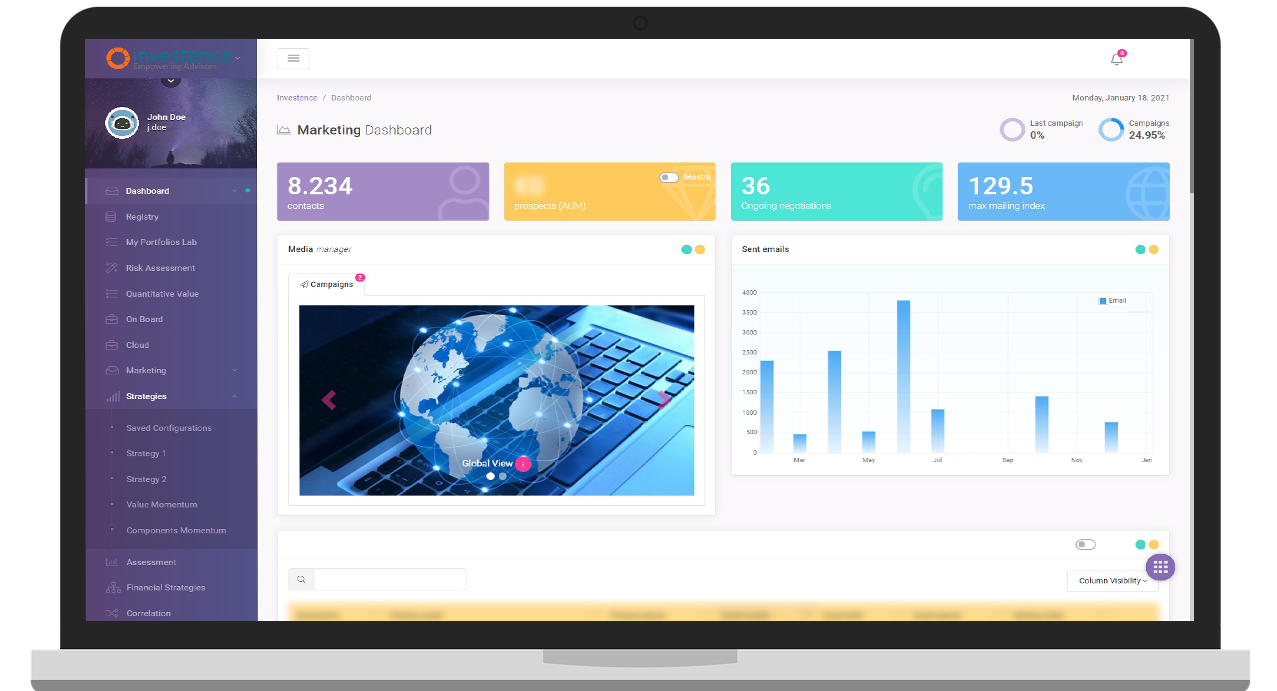

CRM Dashboard

Prospect Clients

Automated Content Marketing and Opportunity Tracking.Existing Clients

Activity Streams and Digital Content Marketing.Extra Features

Social Media Posts Automation. Tags Engine.

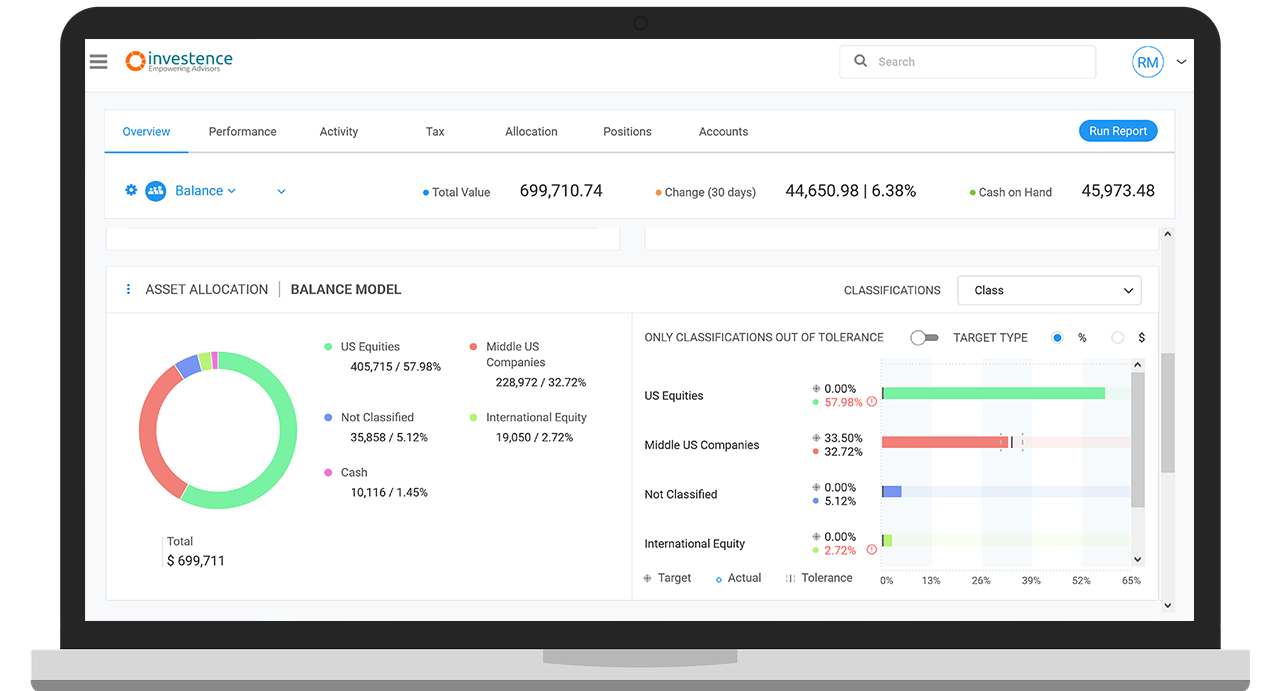

Advisor Dashboard

Actionable Evidence Based Model Portfolios. Rebalancing Engine.

Customisable Modules

Model Portfolio Academic Research

- - Science backed questionnaire

- - Device neutral front-end

- - Portfolio construction framework

- - Hybrid robo-human module

- - Tilting preferences

(sectors, ESG, committe views, etc) - - Engaging customer onboarding

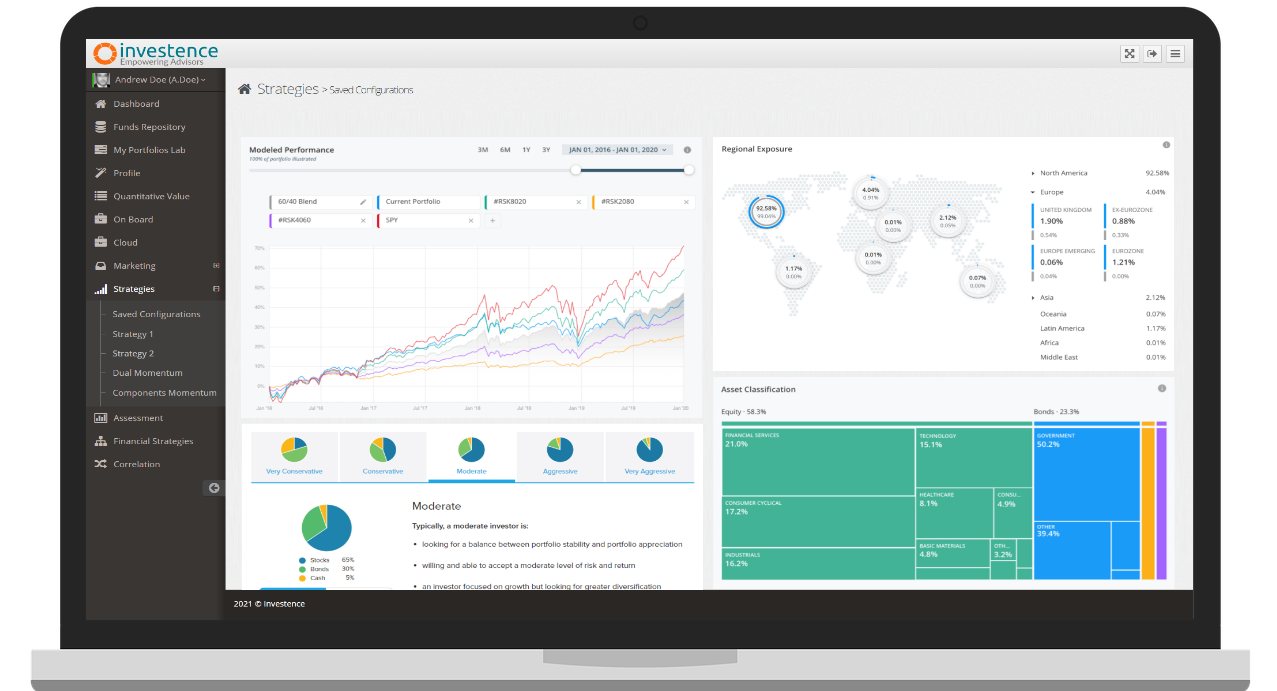

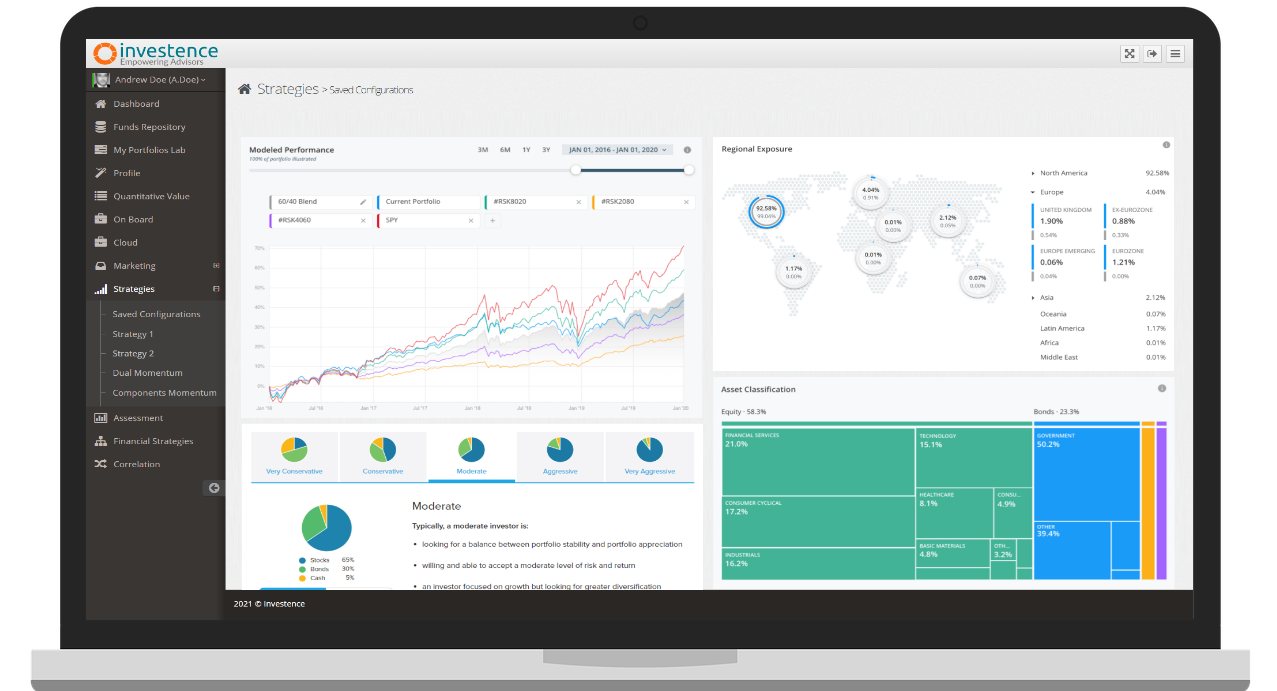

We scout for the latest academic research that backs successful investing ideas and we make it actionable as a disciplined investment approach designed to meet advisor's clients unique goals.

We built a menu of evidence based model portfolios. Our models are designed to help advisors seeking better returns for their clients throughout a spectrum of risk objectives including conservative, moderate and aggressive.

You can combine different evidence based investment strategies. Examine your portfolio allocations by geography & market sector.